Washington – SABA:

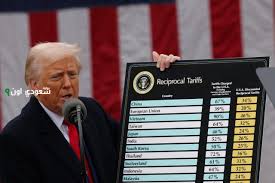

European stocks fell on Monday following U.S. President Donald Trump’s announcement of his intention to double tariffs on steel and aluminum imports.

At the close of trading, European markets dropped amid rising fears of a new trade tension. Trump’s announcement to raise tariffs from 25% to 50% triggered concerns and prompted the European Union to prepare for retaliatory measures.

The pan-European Stoxx 600 index closed down by 0.1%, weighed by anxiety over looming U.S. trade policies that could reignite global trade conflicts. This comes after a strong performance in May, where the index gained 4%.

Industrial stocks were particularly hit, with the European auto sector dropping 2.1%, the largest decline among all sectors. Shares of Stellantis on the Milan exchange plunged 5%, while major automakers like Mercedes-Benz, BMW, and Volkswagen saw losses ranging from 1.9% to 2.7%.

Luxury goods companies, heavily reliant on exports, also suffered; the luxury sector index slipped 0.8%.

Meanwhile, the European market volatility index rose by 4.3%, its highest level in a week, reflecting growing caution among investors.

Steve Sosnick, chief market strategist at Interactive Brokers, commented, “Markets have shifted into risk-off mode,” adding that “each new statement from Trump has less impact than before, as investors have grown used to this rhetoric… However, it still can’t be fully ignored.”

| more of (Economy) |