SANA'A November 11. 2023 (Saba)- Oil prices in the world have witnessed rapid changes since the beginning of last October. Its prices jumped by 4% due to fears of deteriorating conditions and the repercussions of production disruption in the Middle East region.

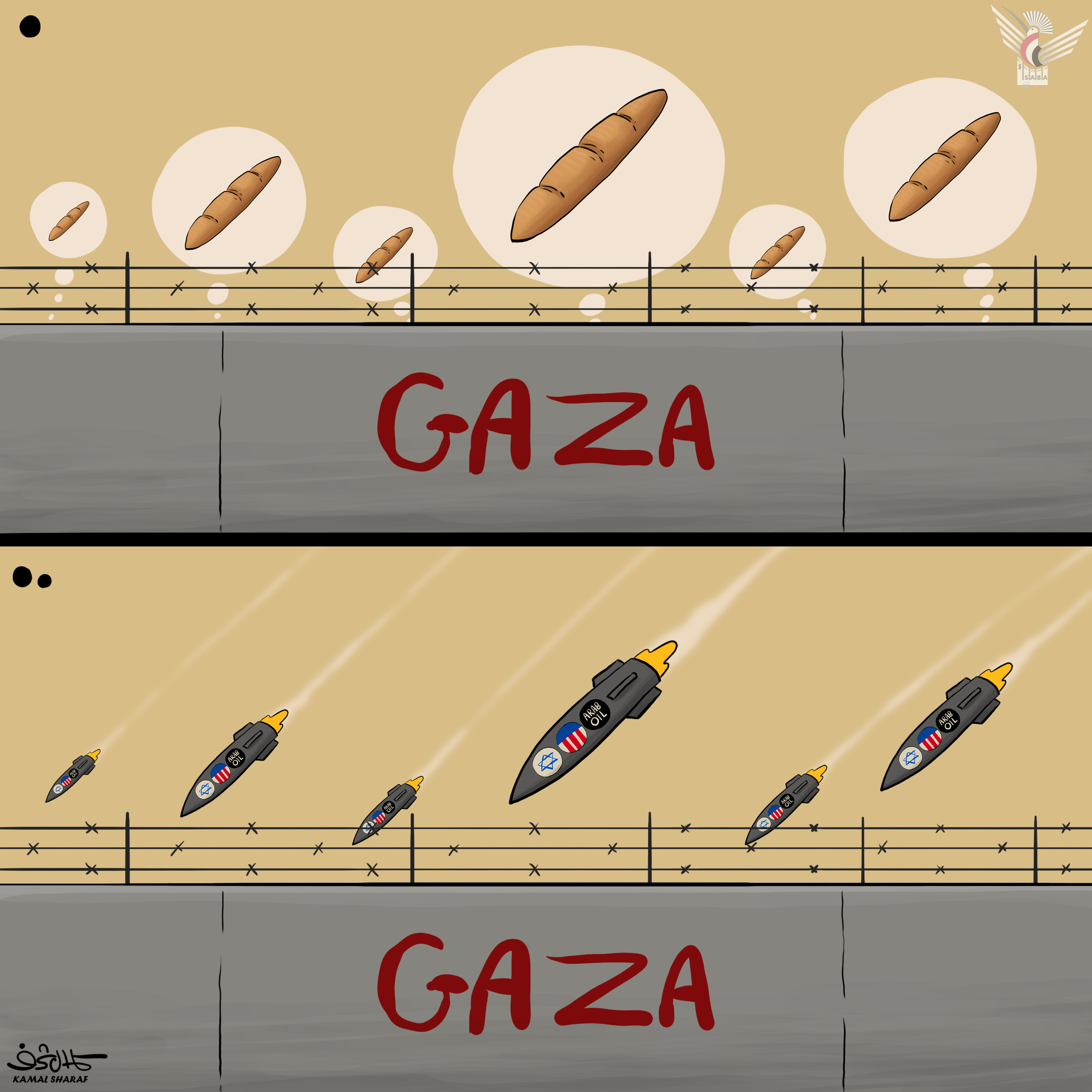

Oil prices in general were greatly affected after a strong decline in trading last October since the situation deteriorated in the region, especially in light of the American-Zionist aggression on the Gaza Strip. This raised the concerns of international economic officials and their concern about the aggravation of the rise, especially after the announcement of Saudi Arabia and Russia, the two largest countries. Two oil exporters in the world have continued to voluntarily reduce their production until the end of this year, causing an increase in demand for the supplied oil and thus raising its prices.

According to news agencies, the Saudi Ministry of Energy confirmed in a statement that it would continue to reduce its voluntary oil production in line with analysts’ expectations, in order to enhance the precautionary efforts made by OPEC countries with the aim of supporting the stabilization process of global oil markets.

This trend coincided with Moscow's announcement that it would also continue a voluntary reduction in production by 300,000 barrels per day from its exports of crude oil and petroleum products until the end of next December.

This translated into practice for the second week in a row after the announcement, with a decline of about 6 percent, driven by a reduction in the geopolitical risk premium that arose from fears of supply disruptions due to the possibility of expanding conflict and war in the Arab region and the Middle East following the repercussions of Operation Al-Aqsa Flood.

The World Bank had expected in a report at the end of last October that the escalation of the conflict in the Middle East would contribute to pushing global oil prices to rise, expecting prices to average $90 per barrel in the last quarter of 2023, and $81 per barrel on average next year with Slowing pace of global economic growth.

The report explained that the effects of the conflict on global commodity markets are limited so far, indicating that oil prices have generally risen by about 6% since the beginning of the repercussions of the situation in the region since the start of Operation Al-Aqsa Flood against the Zionist entity occupying the Palestinian territories.

The report indicated that the World Bank expected three scenarios for risks to the oil market and its relationship to oil supplies, as these scenarios were based on previous conflicts in the region.

The first scenario focused on a “minimal disruption,” in which global oil supplies would decline by 500,000 to 2 million barrels per day, and the oil price would initially rise between 3% and 13% compared to the current quarterly average of $93 and $102 per barrel.

While the second scenario indicated a “moderate disruption,” where global oil supplies would decline by between 3 million and 5 million barrels per day, with prices rising by 21% to 35% initially, at $109 and $121 per barrel.

While the third scenario went for the “major disruption,” in which global oil supplies would shrink by 6 million to 8 million barrels per day, pushing prices up by 56% to 75% initially at $140 and $157 per barrel.

The report pointed out that the minor effects of the current conflict so far on commodity prices may reflect the improvement in the global economy’s ability to gradually absorb oil price shocks.

International experts and economists considered that severe shocks in oil prices would lead to higher inflation rates in the prices of food and basic goods, and their effects would increase remarkably, especially in developing countries.

This was confirmed by the Deputy Chief Economist and Director of the Development Prospects Group at the World Bank, Ayhan Kosi, indicating that the continued rise in oil prices inevitably means a rise in food prices, accompanied by a rise in inflation rates in food prices, which are already high in many developing countries.

Economic analysts published their own tweets in which they pointed out that the risk premium associated with the geopolitical background had completely disappeared after two weeks of volatile prices, indicating that the market’s focus had shifted to demand expectations that were still uncertain.

They reported that investors are currently looking forward to more economic data from China after it - the second largest oil consumer in the world - issued disappointing factory data last October.

According to international agencies, Tony Sycamore, an analyst at IG Markets in Sydney, Australia, expected oil prices to be affected by news coming from the Middle East and technical charts.

He pointed out that West Texas Intermediate crude oil needs to remain above the support level at $80 per barrel, otherwise prices may fall to the lowest level at $77.59 that the indices recorded last August.

Economic reports stated that members of OPEC - a group of oil-producing countries - agreed to continue production cuts in an attempt to support the deteriorating prices of oil, as OPEC represents about 40% of crude oil in the world and its decisions can have a significant impact on oil prices.

Oil prices in the world are also affected by supply and demand factors, geopolitical developments, production and manufacturing costs, global economic fluctuations, and emergency events such as natural disasters, wars, explosions, accidents, and the influence of OPEC.

Regarding the prices of gasoline and diesel, the Global website reported in its bulletin on November 6 that the average price of gasoline around the world is 1.33 US dollars per liter, and the average price of diesel around the world is 1.30 US dollars per liter, indicating that there is a large difference in these prices. Among countries, as a rule, rich countries have higher prices while poor countries and countries that produce and export oil have much lower prices.

The rise in the stock market price of crude oil and the increase in refining are among the most prominent factors that led to an increase in the prices of petroleum derivatives, diesel and gasoline.

The prices of gasoline and diesel also differ from the price of serving oil, which still needs the refining process.

This is confirmed by one of the economic studies, which stated that the pricing of petroleum products is linked to the main costs that are part of the determinants of their productivity, which are a large number of factors, the most prominent of which is the global price of crude oil, as countries use it as an indicator to determine the global price of a barrel of oil, in addition to the exchange rate of the US dollar, as well as costs transportation and circulation, which are mainly related to the costs of providing these petroleum products at citizens’ supply stations.

Najat

resource : Saba

| more of (Reports) |